Customer retention is crucial since, on average, it costs five times as much to attract a new customer than it costs to retain a current customer. Retaining your existing customers is challenging, and that’s why it’s so important to understand your customer churn rate.

What Is Churn Rate?

Churn rate is the percentage of customers that cancel their accounts or stop paying over a period of time and can help gain an understanding of customer satisfaction of your product and services There are two types of churn; voluntary and involuntary.

Voluntary churn is where the customer has consciously made the decision to stop paying. This could be because they aren’t using your product anymore, simply can’t afford it, or have had a horrible customer experience.

Involuntary churn is when an account has been canceled by default. This could be because the card payment details have expired and not been updated so payment wouldn’t go through.

A high customer churn rate indicates that you are losing customers rapidly. If your churn rate is above 100%, you lose customers faster than you gain them. An acceptable churn rate between 2-8%. It's worth noting that the average churn rate may differ depending on your industry.

How Do You Calculate Churn Rate?

Calculating customer churn rate is pretty straightforward because the formula is the same across all industries. You can calculate churn rate by taking the total number of churned customers (e.g. customers that have canceled their accounts or stopped paying) over a time frame (this could be a monthly or annual basis) and dividing that number by your total number of customers at the start of that same time period. Once you have this number, you simply need to multiply it by 100 to get your percentage. Typically you would calculate a monthly churn rate instead of other time periods.

For example, if you started with 1000 customers in January and lost 50 customers by the end of the month, your monthly churn rate would be 5%. This same formula can be applied to calculate your annual, quarterly, or all-time churn rate.

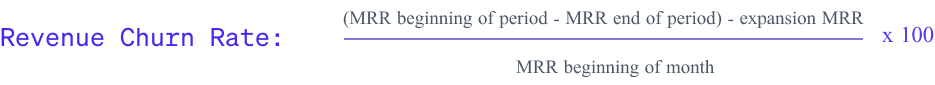

What is Revenue Churn Rate And How To Calculate It

Closely related to churn rate is revenue churn rate. Both churn rate and revenue churn rate should be analyzed together. You could have a situation where you’re losing more customers, but your revenue is increasing.

Losing customers is still bad (unless this is part of a strategic plan, like firing all your bad customers), but if your current customers keep spending more, you’ll have a positive result overall.

You can calculate the revenue churn rate similar to churn rate using the below formula.

For example, if you started with $157,938 monthly recurring revenue (MRR) in June and lost $4,594 MMR by the end of the month, your revenue churn rate would be 34.38%. This same formula can be applied to calculate your annual, quarterly, or all-time revenue churn rate.

Why Does Churn Rate Matter?

Churn rate is important because it’s a strong indicator of how good your product is in producing loyal customers and how satisfied your customer base is. Your churn rate shows exactly how healthy your overall business is. If you’re not recouping your average customer acquisition costs (CAC) you’re losing money.

One impact that tracking churn rate can do is to force you to be reactive (you only know after a customer has churned.) In reality, it makes more sense to leverage churn rate to be proactive so instead of having to take corrective action, you reduce the risk of your customers churning before they actually do.

Knowing the churn rate percentage is far less useful than having a churn score to reduce the risk of your customer churning proactively. For example, your customer’s last login date might be directly correlated with their cancellation, or you might notice that many of your renewal customers are canceling. This is why defining a churn score is far more impactful than simply understanding your churn rate.

With churn score, you can define specific criteria and behavioral attributes you want to track using your 1st-party data and assign positive and negative points to those criteria using a lead scoring system. These metrics might be based on:

- Number of users

- Last login date

- Messages sent

- Workspaces created

- Active users

- Inactive users

- Time spent in-app

- Subscription type

- Last order date

Depending on your service or product, these criteria will differ substantially. However, once you’ve aligned on a core set of metrics, you can proactively work to reduce your churn rather than react once your customers have already churned.

What Are the Impacts of Churn Score?

Providing your business teams across sales, marketing, and support with a churn score can have huge implications because it allows your business teams to take action to help customer retention rates.

With a churn score in place, your support teams can prioritize the highest value tickets in real-time using your product usage data, your sales team can identify possible red flags, and your marketing team can enroll your users in nurture campaigns to keep them engaged with your brand.

When one of your customers takes action affecting their churn score, you can notify the appropriate team in real time and customer retention action can be taken. With a churn score for each of your customers, you can ensure that you are constantly working to improve your retention rate and build better customer experiences.

How to Implement Churn Score

As mentioned in the article, churn rate on its own may not be useful to you. But having a churn score for each customer in your data warehouse can really make a difference. The problem of syncing data from your warehouse to your downstream business tools can be challenging as it requires you to integrate with third-party APIs and build and maintain custom pipelines.

Reverse ETL platforms like Hightouch completely eliminate this problem. With Hightouch, you can leverage all of your existing data models in the warehouse or simple SQL to sync data to 250+ destinations. You simply define your data and map it to the proper fields in your end destination. You can sign up for a free Hightouch Workspace today to get started!

Each company’s churn rate will differ depending on the actions and behaviors your customers can do and how much their impact a customer churning.

A churn score is worthless unless you’re taking action on it. Hightouch makes taking action on a churn score easy by allowing you to set up notifications when customers exceed a specific score that you set so that action can be taken immediately.