The ultimate guide to CDPs for automotive

Learn everything there is to know about CDPs in automotive, including global trends, key insights, use cases, how leading auto companies are leveraging personalization, and a framework for evaluating CDP vendors.

Why are auto companies adopting CDPs?

Auto customers are more informed than ever before and they have more options than ever before. They expect car shopping and service to feel seamless. With 80% of revenue coming from just 20% of customers,1 customer loyalty is everything. Data is your only advantage to stand out in a sea of virtually endless options.

Industry leaders in automotive differentiate themselves with personalization

Cars.com leverages Hightouch to deliver re-engagement emails to increase conversions by 3%

Auto Trader is using individual session data to personalize lifecycle marketing campaigns, to increase new car buyer engagement by 20%

True Car is monetizing 1st party audiences to dealerships across 550+ car buying websites

automotive use cases

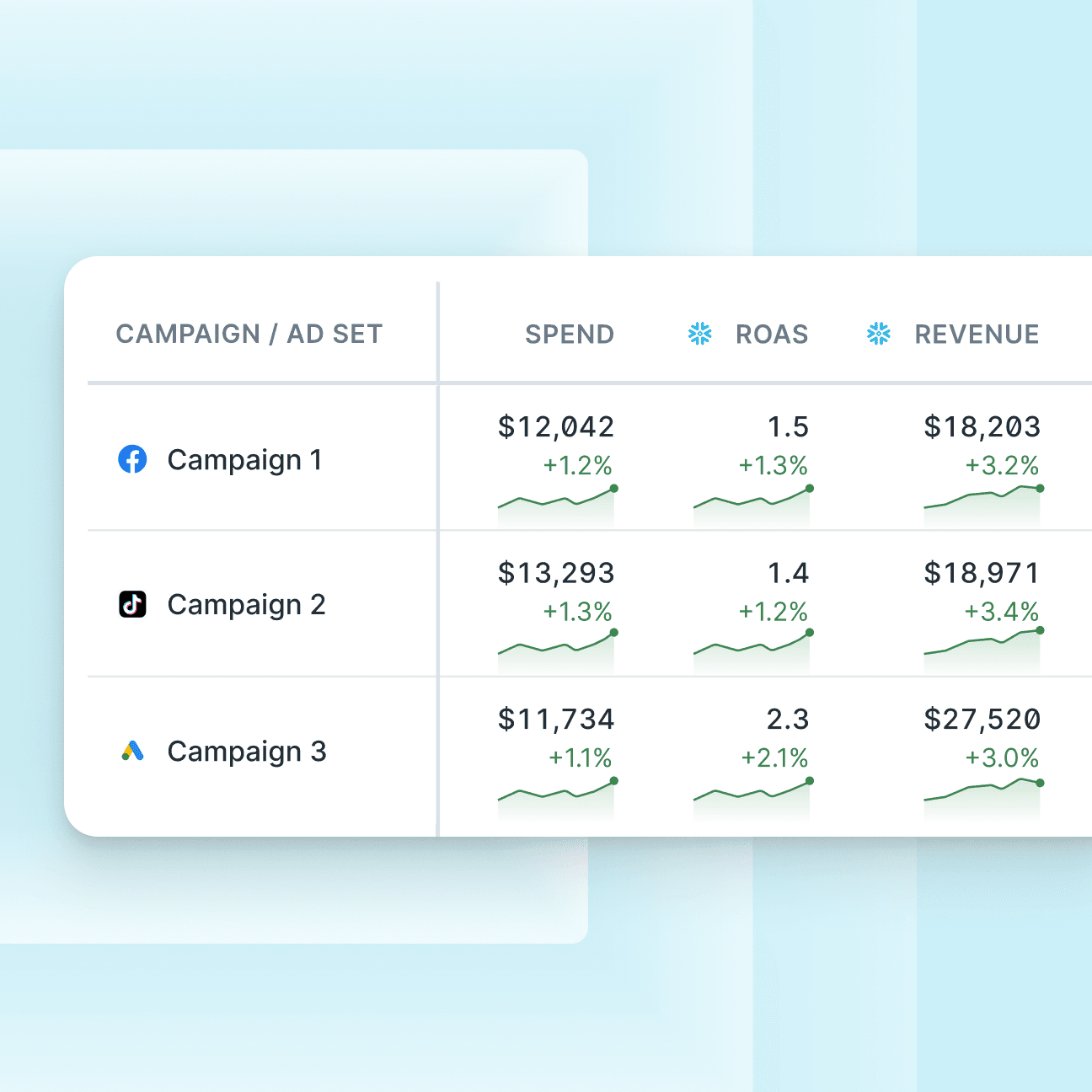

Acquisition campaigns

Drive new vehicle purchases or marketplace sign-ups by using demographic and browsing data to target potential customers and lookalike audiences with tailored promotions.

Suppression campaigns

Reduce wasted ad spend by suppressing recent buyers from acquisition campaigns using CRM and purchase data, reallocating budget toward net-new prospects.

Retargeting campaigns

Re-engage users who browsed vehicles or products but didn’t convert by serving dynamic ads showcasing their viewed items, recovering lost leads.

Seasonal promotions

Drive purchases during key automotive sales events by promoting seasonal discounts like end-of-year clearance or holiday offers, increasing vehicle sales.

Conversion APIs

Share online and offline conversion data with ad platforms, enabling algorithms to better identify and target users with a higher likelihood of converting to improve campaign performance.

Automotive media networks

Monetize customer insights by offering anonymized vehicle ownership and service data to brand partners for targeted advertising, generating incremental revenue through audience data sales.

Upsell & cross-sell campaigns

Recommend extended warranties, premium accessories, or service plans to increase customer value.

Service reminders

Notify customers when maintenance is due to improve retention and service revenue.

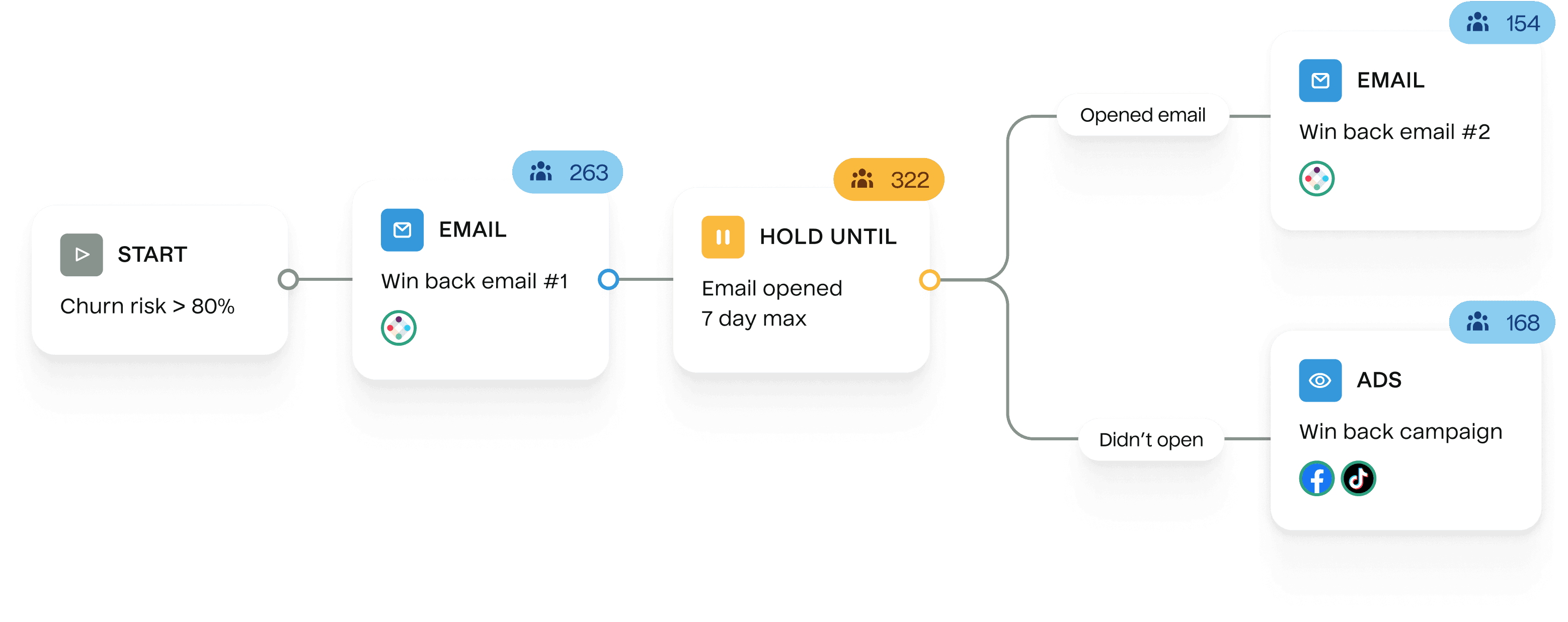

Reactivation campaigns

Offer service discounts or incentives to bring back lapsed customers.

Seasonal care campaigns

Highlight seasonal services like tire installations and AC checks to boost revenue.

Trade-in campaigns

Encourage existing owners to upgrade with trade-in incentives.

Accessory campaigns

Promote lifestyle accessories like bike racks or floor mats to drive incremental revenue.

Dynamic home page content

Display featured vehicles, trending models, and financing options based on browsing history to increase engagement and lead generation.

Dynamic search results

Adjust search rankings to highlight best deals, trending vehicles, or nearby inventory, improving search-to-purchase conversion rates.

Next best action

Guide users toward completing high-impact actions like scheduling a test drive, getting pre-approved for financing, or contacting a dealer to boost lead conversion.

Vehicle upgrade suggestions

Use ownership duration and mileage data to recommend upgrading to newer models, encouraging repeat purchases and brand loyalty.

Interactive feature demonstrations

Provide interactive walkthroughs or videos showcasing unique features like autonomous driving, infotainment systems, or safety technology to create excitement and increase engagement.

Test drive scheduling

Personalize booking prompts based on vehicles users have browsed or saved, streamlining the test drive process and increasing conversion rates.

What auto companies should consider when evaluating a CDP

90%5 of marketers say their traditional CDP does not do what they need, so why do they keep buying them?

| Category | Traditional CDP | Composable CDP |

|---|---|---|

| Architecture | Operates as a separate entity, removed from your company’s data | Integrates directly within your company’s data infrastructure |

| Security & data storage | Data is stored and maintained in the CDP’s data infrastructure | Data is stored and maintained in your existing data infrastructure |

| Data access | Supports user and event data | Supports both online and offline data |

| Data modeling | Uses predefined models that may not fully capture ownership lifecycles or service intervals | Supports tailored models to handle vehicle ownership, service histories, and purchasing preferences |

| Audience management | Supports broad segmentation but struggles with identifying prospective buyers or vehicle upgrade needs | Enables granular segmentation based on ownership duration, service records, and customer preferences |

| Customer journey customization | Provides standard templates for campaigns like test drive scheduling or service reminders | Powers fully adaptable journeys for events like lease renewals, service promotions, and first-time buyer campaigns |

| Identity resolution | Relies on out-of-the-box algorithms that may not unify profiles across dealership systems and vehicle finance platforms | Supports custom algorithms to unify profiles from dealership records, finance systems, and aftermarket services |

| Pricing | Bundled pricing: dependent on monthly tracked users (MTUs) & feature add-ons | Unbundled: individually priced features with no MTU billing |

| Average implementation time | 6-12 months | 1-4 months |

- ArchitectureIntegrates directly within your company’s data infrastructure

- Security & data storageData is stored and maintained in your existing data infrastructure

- Data accessSupports both online and offline data

- Data modelingSupports tailored models to handle vehicle ownership, service histories, and purchasing preferences

- Audience managementEnables granular segmentation based on ownership duration, service records, and customer preferences

- Customer journey customizationPowers fully adaptable journeys for events like lease renewals, service promotions, and first-time buyer campaigns

- Identity resolutionSupports custom algorithms to unify profiles from dealership records, finance systems, and aftermarket services

- PricingUnbundled: individually priced features with no MTU billing

- Average implementation time1-4 months

- ArchitectureOperates as a separate entity, removed from your company’s data

- Security & data storageData is stored and maintained in the CDP’s data infrastructure

- Data accessSupports user and event data

- Data modelingUses predefined models that may not fully capture ownership lifecycles or service intervals

- Audience managementSupports broad segmentation but struggles with identifying prospective buyers or vehicle upgrade needs

- Customer journey customizationProvides standard templates for campaigns like test drive scheduling or service reminders

- Identity resolutionRelies on out-of-the-box algorithms that may not unify profiles across dealership systems and vehicle finance platforms

- PricingBundled pricing: dependent on monthly tracked users (MTUs) & feature add-ons

- Average implementation time6-12 months

Why Hightouch for automotive?

Your CDP vendor should mold to your data — not the other way around. Hightouch is purpose-built to handle the complexity of automotive.

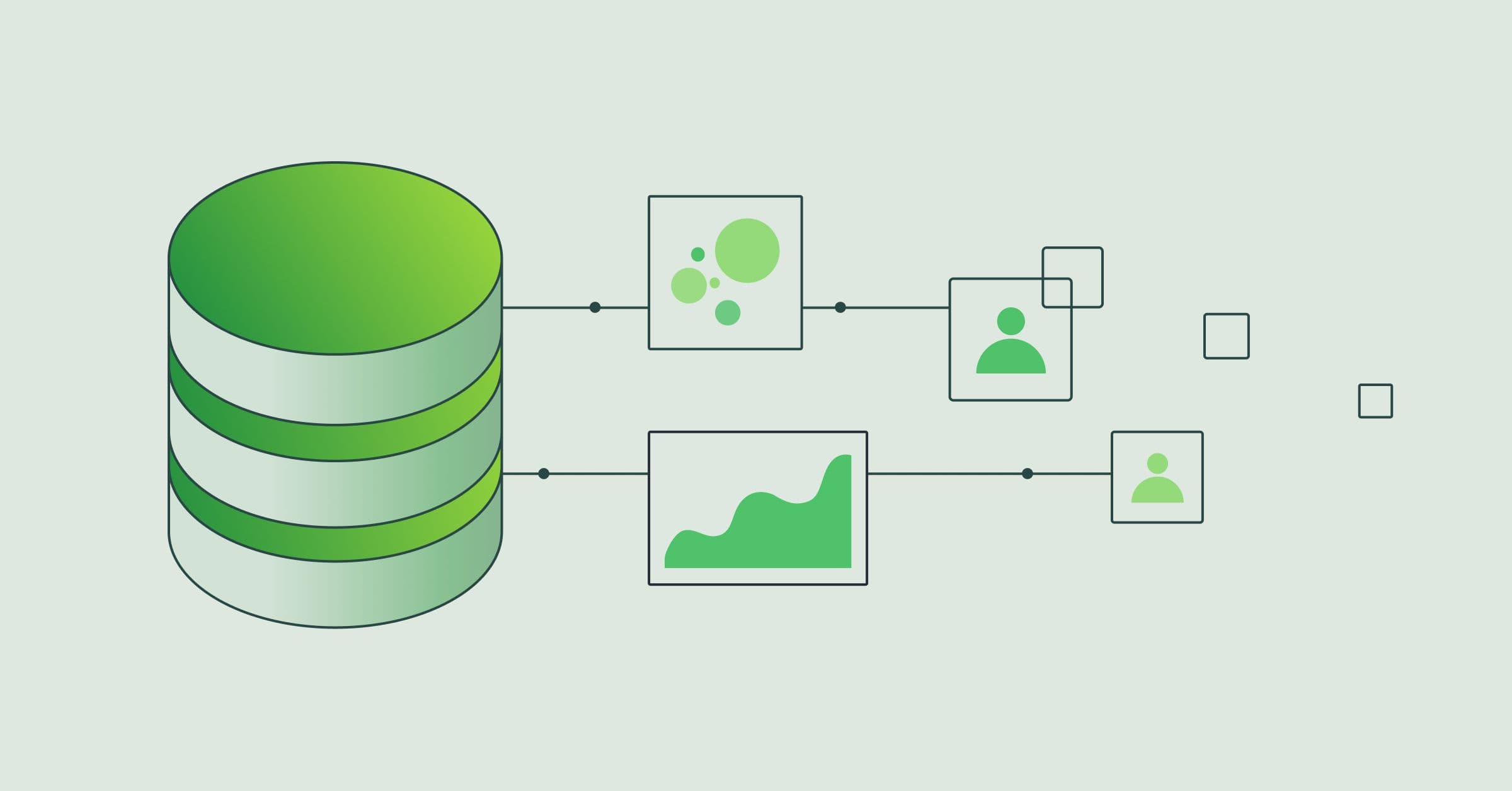

Leverage any data point in your warehouse – not just users, accounts, and events.

Build and activate audiences directly from your warehouse.

Integrate with your existing data infrastructure on your warehouse.

Leverage any data point in your warehouse – not just users, accounts, and events.

A complete CDP for automotive

Members

Overlap

High-intent car buyers

2,988 members

1,974 members

Test drive no-shows 2,988

Online build & price tool users 1,974

Member overlap 378 or 12.65%

Customer Data Platform resources

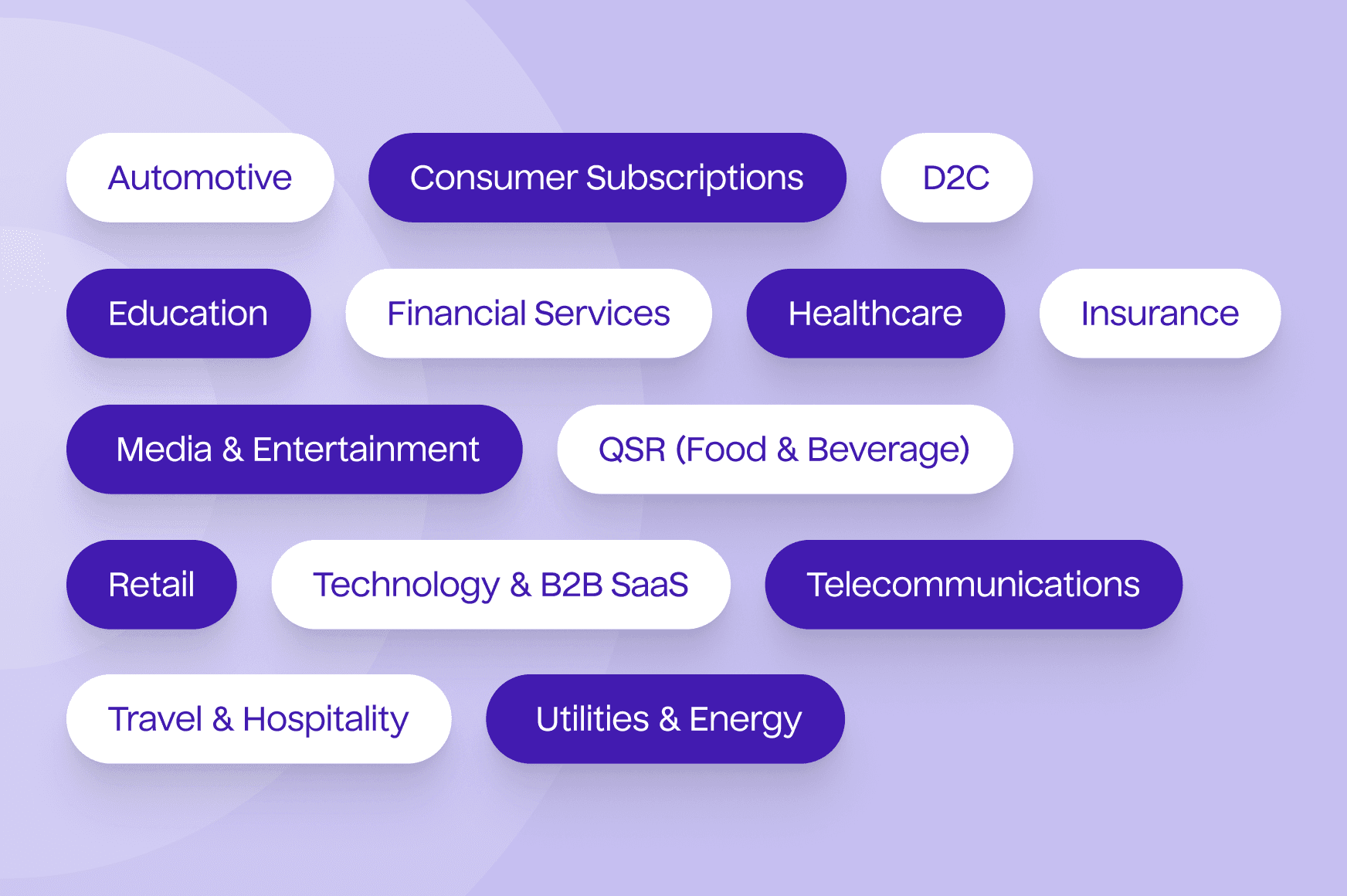

Explore Customer Data Platforms by industry

Discover why leaders across all industries and adopting CDPs and how they are taking action on their customer data to drive engagement and revenue.

Connect to 250+ tools

Send any data to any tool. Skip building and maintaining pipelines, uploading CSVs, and having data silos across marketing, sales, customer success, finance, and analytics.