The ultimate guide to CDPs for insurance

Learn everything there is to know about CDPs in insurance, including global trends, key insights, use cases, how leading insurance companies are leveraging personalization, and a framework for evaluating CDP vendors.

Why are insurance companies adopting CDPs?

Insurance is shifting to digital-first experiences, and customers value transparency, price, and convenience. If you’re not using your data to build trust and meet customer expectations, they’ll churn to one of your competitors.

Industry leaders in insurance differentiate themselves with personalization

Cigna uses machine learning and predictive modeling to power proactive and preventive outreach for better patient outcomes at a lower cost

The Zebra orchestrates complex user journeys across various channels like SMS and email

Allstate analyzes customer data from 16 million households to make churn predictions and enable faster and more personalized claim resolution

insurance use cases

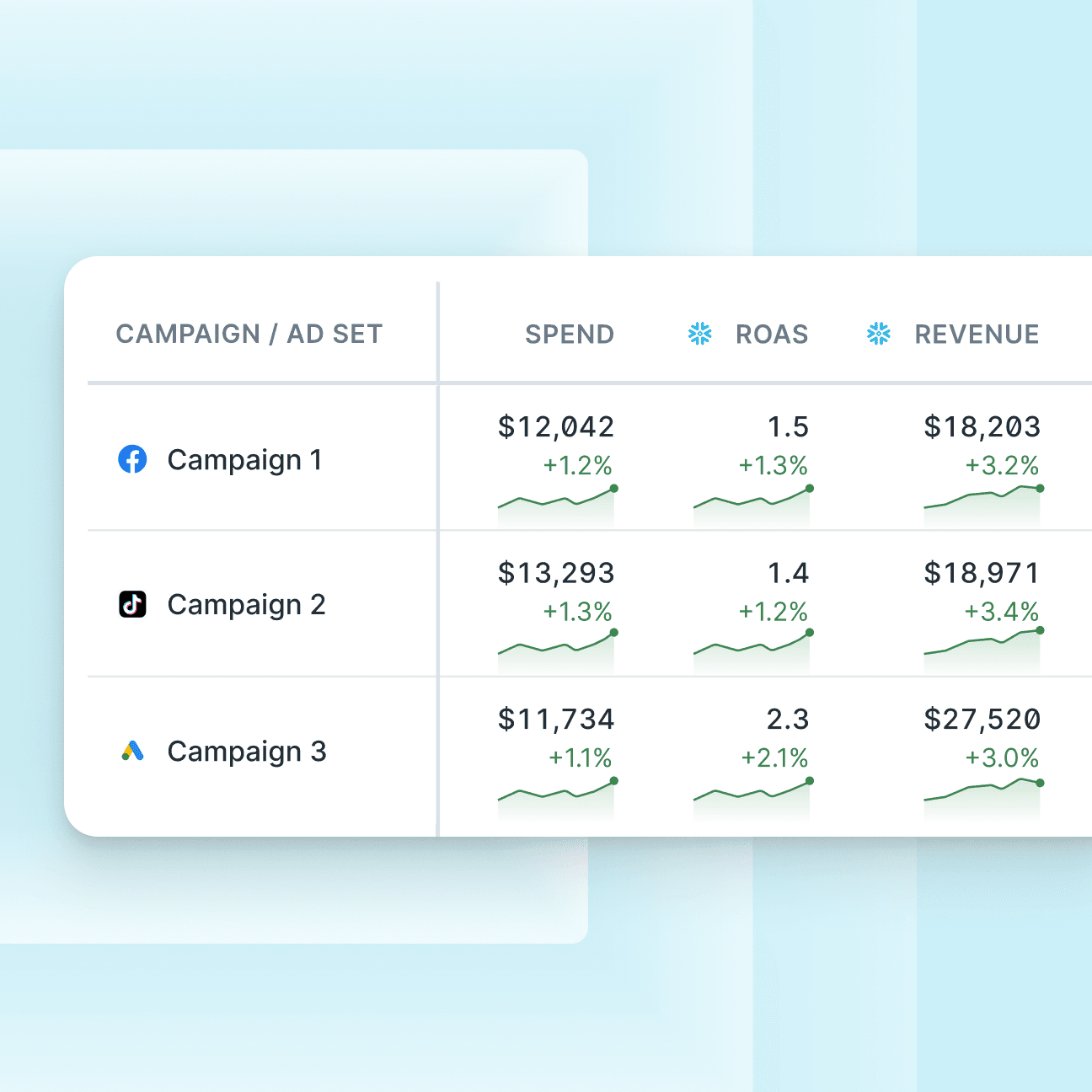

Acquisition campaigns

Drive new policy sign-ups by using demographic and behavioral data to target individuals and lookalike audiences searching for insurance plans, increasing new customer acquisition.

Suppression campaigns

Reduce wasted ad spend by suppressing current policyholders from acquisition campaigns using CRM data, reallocating budget toward competitive policyholders to maximize efficiency.

Retargeting campaigns

Re-engage users who explored policies but didn’t convert by serving dynamic ads highlighting benefits, discounts, or personalized policy recommendations.

Seasonal promotions

Boost policy purchases during high-need periods by promoting life insurance during tax season or home insurance ahead of disaster-prone seasons.

Conversion APIs

Share online and offline conversion data with ad platforms, enabling algorithms to better identify and target users with a higher likelihood of converting to improve campaign performance.

Media networks

Monetize customer insights by offering anonymized audience segments to financial service partners for targeted advertising, generating incremental revenue.

Upsell & cross-sell campaigns

Recommend complementary policies such as life, renters, or home insurance to increase customer policy count.

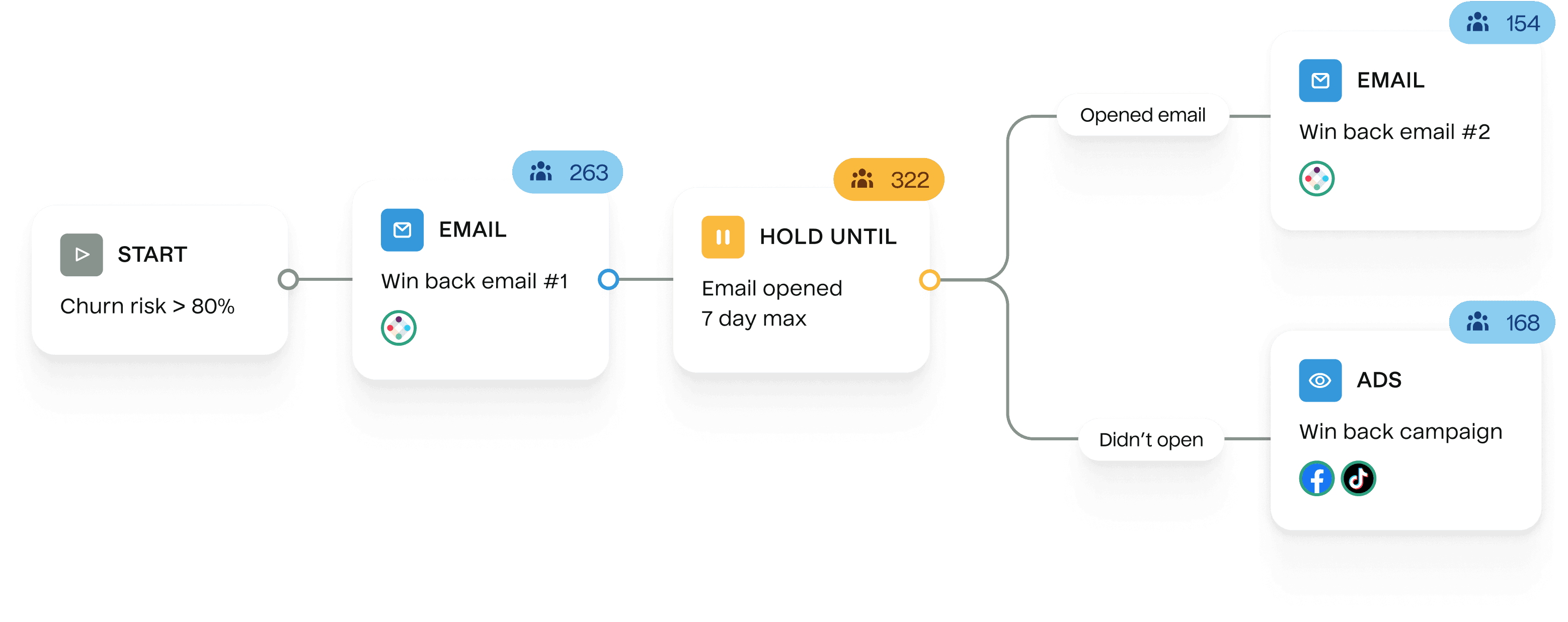

Reactivation campaigns

Offer incentives like waived fees or loyalty discounts to win back lapsed policyholders.

Seasonal campaigns

Promote policies that align with seasonal needs, such as travel insurance for summer vacations or home insurance for wildfire season.

Claims experience campaigns

Provide proactive updates, customer support guides, or automated claims tracking to improve satisfaction during claims processing.

Loyalty rewards campaigns

Reward long-term policyholders with renewal discounts, added benefits, or tiered loyalty rewards.

Localized promotions

Offer specialized coverage for location-specific risks such as earthquake, flood, or hurricane insurance.

Family plan campaigns

Promote family insurance bundles with discounts for covering multiple members under one policy.

Digital adoption campaigns

Encourage policyholders to use self-service apps for billing, claims management, and policy adjustments.

Upcoming renewals

Send reminders with exclusive renewal benefits to prevent churn and secure long-term customer retention.

Dynamic home page content

Display tailored policy recommendations, claims status updates, or renewal reminders to increase engagement and conversions.

Next best action

Suggest actions like enrolling in autopay, bundling policies, or updating coverage limits to drive engagement and incremental revenue.

Claims progress tracking

Provide real-time updates on claims processing through dashboards to enhance customer satisfaction and reduce service-related churn.

Proactive renewal nudges

Notify users about upcoming policy renewals and offer exclusive discounts for early renewals to improve retention and reduce administrative costs.

Gamified rewards

Incentivize positive behaviors such as safe driving or wellness goals by offering rewards, discounts, or points.

Localized risk notifications

Send location-based alerts about upcoming weather risks like storms or floods to improve trust and encourage timely policy adoption.

Customized policy comparison tools

Provide interactive tools for comparing coverage options, deductibles, and premiums to simplify decision-making and boost conversions.

Self-service policy updates

Enable users to make quick policy adjustments, such as adding dependents or changing payment methods, reducing support costs and improving convenience.

Coverage & bundle recommendations

Suggest tailored insurance bundles, coverage upgrades, or discounts based on life events, policy history, and risk profile to increase conversions and customer retention.

What insurance companies should consider when evaluating a CDP

90%5 of marketers say their traditional CDP does not do what they need, so why do they keep buying them?

| Category | Traditional CDP | Composable CDP |

|---|---|---|

| Architecture | Operates as a separate entity, removed from your company’s data | Integrates directly within your company’s data infrastructure |

| Security & data storage | Data is stored and maintained in the CDP’s data infrastructure | Data is stored and maintained in your existing data infrastructure |

| Data access | Supports user and event data | Supports both online and offline data |

| Data modeling | Uses predefined models that may not fully capture policy types claims data or renewal patterns | Supports tailored models to handle insurance policies, claims histories, and customer risk profiles |

| Audience management | Supports broad segmentation but struggles with identifying policyholder segments or claim history trends | Enables granular segmentation using claims, frequency renewal behaviors, and policy types |

| Customer journey customization | Provides standard templates for campaigns like renewal notices or cross-sell offers | Powers fully adaptable journeys for events like claims, follow-ups, new policy adoption, and churn prevention |

| Identity resolution | Relies on out-of-the-box algorithms that may not unify profiles across claims systems and underwriting platforms | Supports custom algorithms to unify profiles across claims databases, policy accounts, and underwriting systems |

| Pricing | Bundled pricing: dependent on monthly tracked users (MTUs) & feature add-ons | Unbundled: individually priced features with no MTU billing |

| Average implementation time | 6-12 months | 1-4 months |

- ArchitectureIntegrates directly within your company’s data infrastructure

- Security & data storageData is stored and maintained in your existing data infrastructure

- Data accessSupports both online and offline data

- Data modelingSupports tailored models to handle insurance policies, claims histories, and customer risk profiles

- Audience managementEnables granular segmentation using claims, frequency renewal behaviors, and policy types

- Customer journey customizationPowers fully adaptable journeys for events like claims, follow-ups, new policy adoption, and churn prevention

- Identity resolutionSupports custom algorithms to unify profiles across claims databases, policy accounts, and underwriting systems

- PricingUnbundled: individually priced features with no MTU billing

- Average implementation time1-4 months

- ArchitectureOperates as a separate entity, removed from your company’s data

- Security & data storageData is stored and maintained in the CDP’s data infrastructure

- Data accessSupports user and event data

- Data modelingUses predefined models that may not fully capture policy types claims data or renewal patterns

- Audience managementSupports broad segmentation but struggles with identifying policyholder segments or claim history trends

- Customer journey customizationProvides standard templates for campaigns like renewal notices or cross-sell offers

- Identity resolutionRelies on out-of-the-box algorithms that may not unify profiles across claims systems and underwriting platforms

- PricingBundled pricing: dependent on monthly tracked users (MTUs) & feature add-ons

- Average implementation time6-12 months

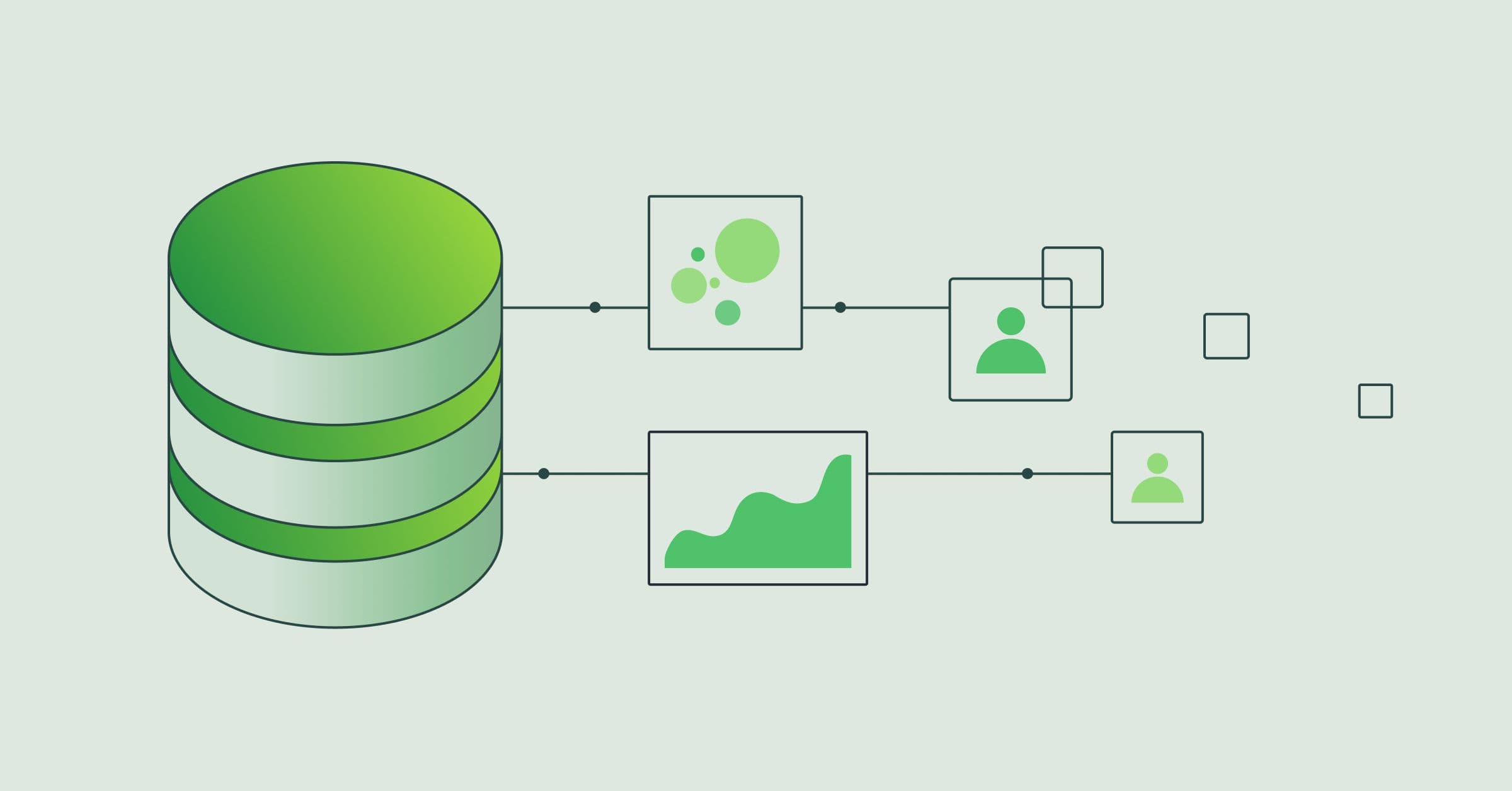

Why Hightouch for insurance?

Your CDP vendor should mold to your data — not the other way around. Hightouch is purpose-built to handle the complexity of insurance.

Leverage any data point in your warehouse – not just users, accounts, and events.

Build and activate audiences directly from your warehouse.

Integrate with your existing data infrastructure on your warehouse.

Leverage any data point in your warehouse – not just users, accounts, and events.

A complete CDP for insurance

Members

Overlap

High-premium policyholders at risk of churn

2,988 members

1,974 members

Policyholders with expiring high-premium plans 2,988

Customers who missed renewal reminders 1,974

Member overlap 378 or 12.65%

Customer Data Platform resources

Explore Customer Data Platforms by industry

Discover why leaders across all industries and adopting CDPs and how they are taking action on their customer data to drive engagement and revenue.

Connect to 250+ tools

Send any data to any tool. Skip building and maintaining pipelines, uploading CSVs, and having data silos across marketing, sales, customer success, finance, and analytics.